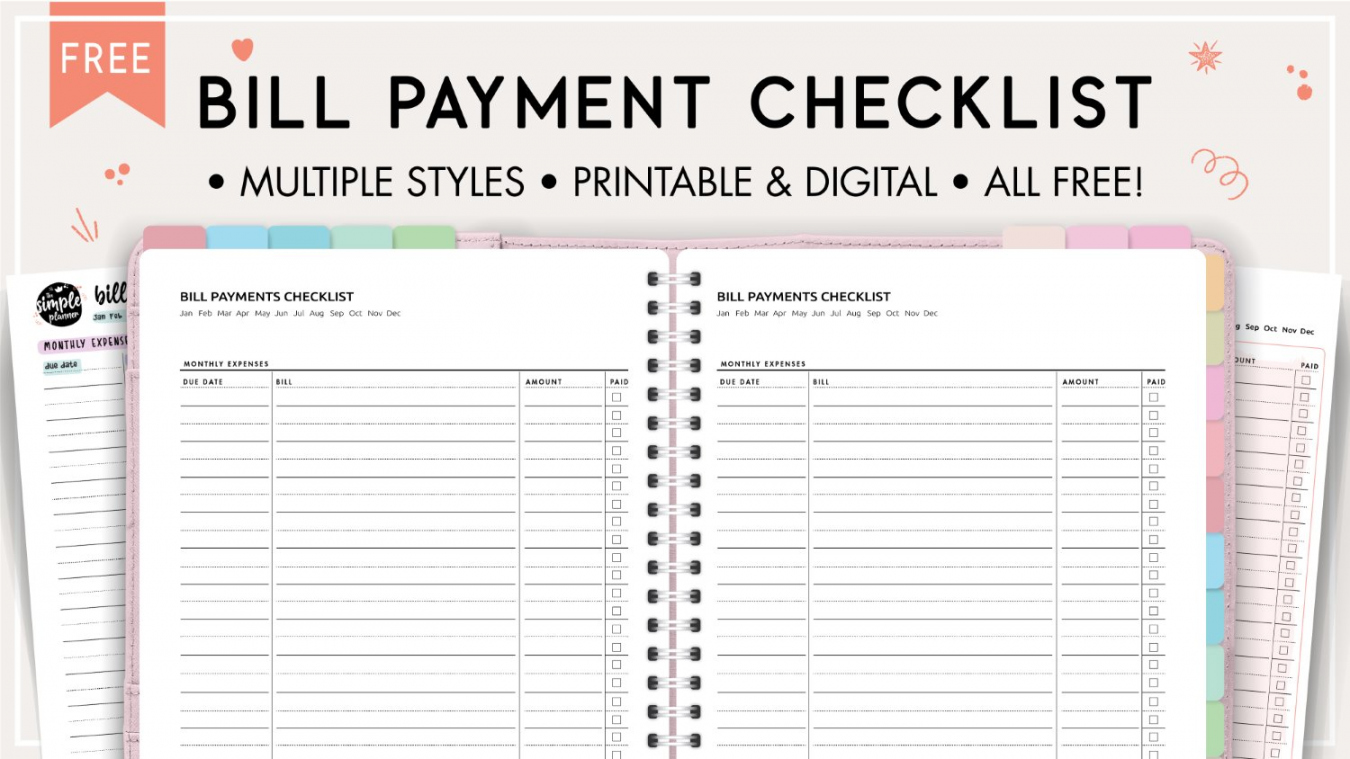

Stay Organized with a Free Printable Bill Pay Checklist

Paying bills can be a mundane and overwhelming task, especially when you have multiple bills to keep track of each month. It’s easy to forget a due date or misplace a bill, leading to late fees and unnecessary stress. However, with the help of a free printable bill pay checklist, you can stay organized and ensure that all your bills are paid on time, every time.

What is a Bill Pay Checklist?

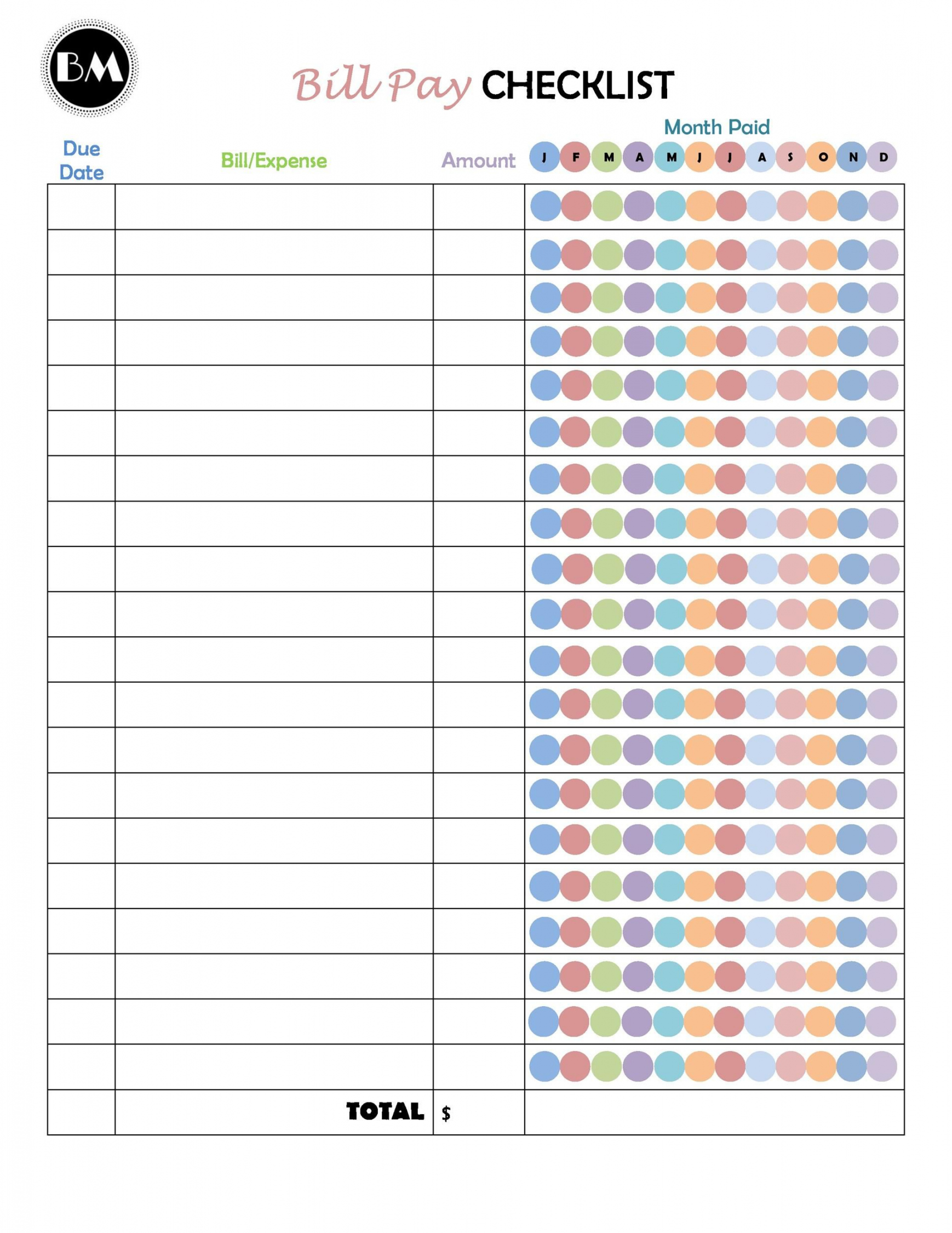

A bill pay checklist is a simple tool that helps you keep track of your monthly bills. It typically includes a list of common household expenses such as rent/mortgage, utilities, credit card bills, and more. The checklist allows you to note down the due date, amount, and whether the bill has been paid or not. By using a bill pay checklist, you can easily see which bills are due, which ones have been paid, and which ones are outstanding.

The Benefits of Using a Bill Pay Checklist

![]()

Using a bill pay checklist offers several benefits:

1. Organization and Peace of Mind

By having all your bills listed in one place, you can easily see what needs to be paid and when. This eliminates the stress of forgetting a bill or missing a due date. With a bill pay checklist, you can stay organized and have peace of mind knowing that your bills are being taken care of.

2. Avoid Late Fees and Penalties

Missing a bill payment can result in late fees and penalties, which can add up over time. With a bill pay checklist, you can ensure that all your bills are paid on time, helping you avoid these unnecessary charges. By keeping track of due dates, you can plan ahead and make timely payments.

3. Track Your Spending

A bill pay checklist also allows you to track your spending. By noting down the amounts for each bill, you can easily see how much money is going towards your monthly expenses. This helps you budget better and identify areas where you can potentially save money.

4. Stay on Top of Your Finances

With a bill pay checklist, you have a clear overview of your monthly financial obligations. You can see which bills are recurring and which ones are one-time payments. This helps you plan your budget accordingly and stay on top of your finances.

How to Use a Free Printable Bill Pay Checklist

Using a free printable bill pay checklist is simple and straightforward:

1. Download and Print

Start by downloading a free printable bill pay checklist template. You can find several templates available online. Once downloaded, take a printout of the checklist.

2. Fill in Your Bill Details

Using a pen or marker, fill in the details of each bill on the checklist. Include the name of the bill, due date, amount, and whether it has been paid or not. You can also add any additional notes or reminders.

3. Update Regularly

Make it a habit to update your bill pay checklist regularly. As you make payments, mark them as paid on the checklist. If a bill is recurring, you can simply update the due date and amount each month. By keeping the checklist up to date, you can ensure its effectiveness in helping you stay organized.

The Convenience of a Printable Checklist

A printable bill pay checklist is a convenient tool that allows you to stay organized and on top of your bills. Whether you prefer a digital checklist or a physical printout, the key is to find a method that works best for you. By using a bill pay checklist, you can take control of your finances and ensure timely payment of your bills, ultimately reducing stress and saving money.

In conclusion, a free printable bill pay checklist is a valuable resource that helps you manage your bills effectively. By using this tool, you can stay organized, avoid late fees, and track your spending. Download a free template today and take the first step towards a more organized and stress-free bill payment process.

Expand Your Collection with More Free Printables…

Copyright Notice:

The images on our website have been sourced from the internet, and the copyrights remain with the original owners. For removal of any image, kindly contact us.