Free Printable Debt Payoff Worksheet: Take Control of Your Finances

Being in debt can be overwhelming and stressful, but with the right tools and strategies, you can regain control of your finances. One such tool that can help you on your journey to becoming debt-free is a free printable debt payoff worksheet. This simple yet effective worksheet allows you to visualize your debts, track your progress, and stay motivated to achieve your financial goals. In this article, we will explore the benefits of using a debt payoff worksheet and provide you with a free printable version to get started.

The Benefits of Using a Debt Payoff Worksheet

1. Organize Your Debts: A debt payoff worksheet allows you to create a comprehensive list of all your debts in one place. This includes credit card balances, student loans, car loans, and any other outstanding debts. By having a clear overview of your debts, you can prioritize them and create a plan of action.

![]()

2. Track Your Progress: With a debt payoff worksheet, you can easily track your progress as you make payments towards your debts. As you update the worksheet each month, you will see your outstanding balances decreasing and your progress improving. This visual representation can be highly motivating and encourage you to stay on track.

3. Set Realistic Goals: A debt payoff worksheet allows you to set realistic goals by determining how much you can allocate towards debt repayment each month. By analyzing your income, expenses, and debts, you can create a budget that works for you and helps you achieve your financial goals.

4. Stay Motivated: It’s easy to lose motivation when tackling large amounts of debt. However, a debt payoff worksheet serves as a constant reminder of why you are working towards becoming debt-free. As you update the worksheet and see your progress, it can provide a sense of accomplishment and inspire you to keep going.

How to Use a Debt Payoff Worksheet

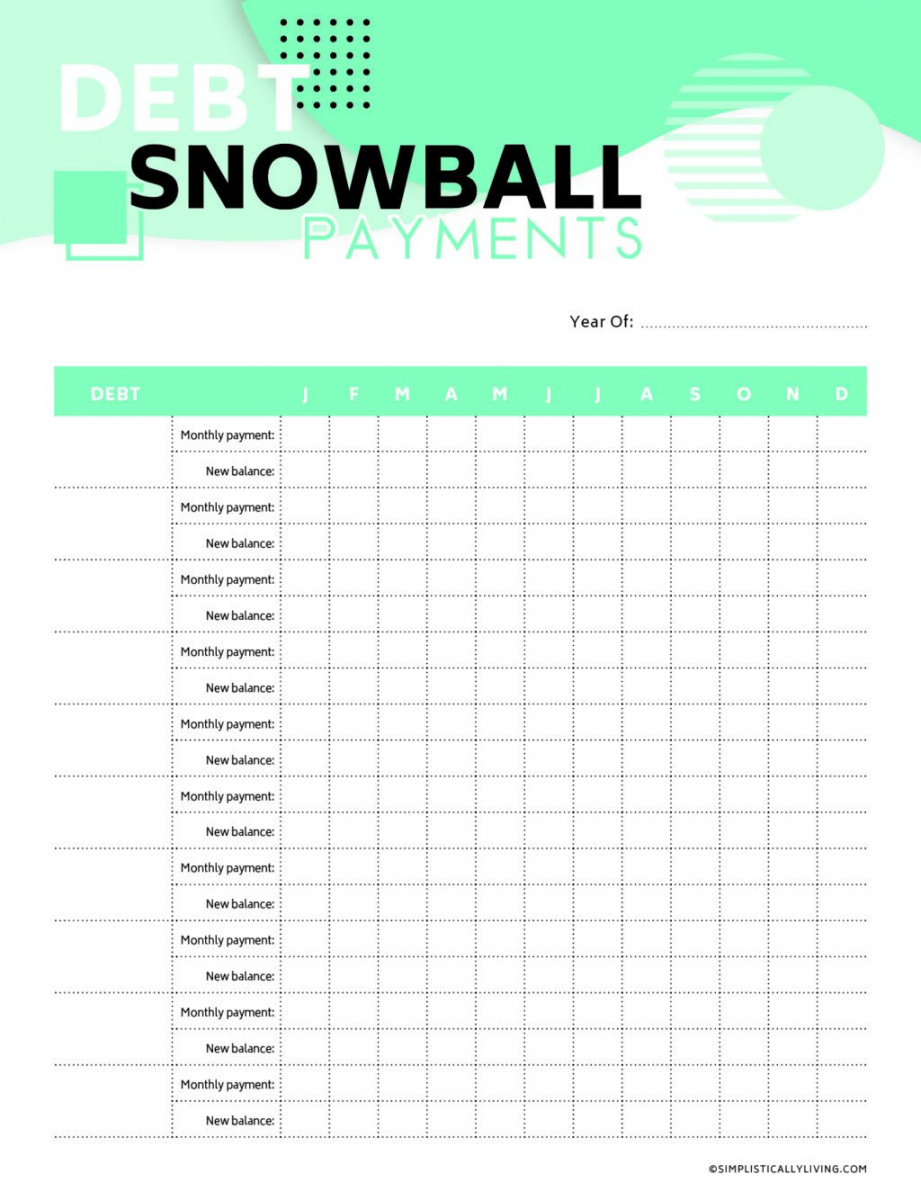

1. Download and Print: Start by downloading and printing a free printable debt payoff worksheet. You can find various templates online that suit your preferences and needs.

![]()

2. List Your Debts: Begin by listing all of your debts on the worksheet. Include the name of the creditor, outstanding balance, minimum monthly payment, and interest rate. This information will help you prioritize your debts and create a repayment plan.

3. Enter Your Monthly Budget: Determine how much you can afford to allocate towards debt repayment each month. This may require adjusting your budget and cutting back on unnecessary expenses. Enter this amount on the worksheet, as it will help you calculate the time it will take to pay off each debt.

4. Track Your Progress: Update the worksheet each month by recording your new balances and payments made. This will help you track your progress and see how far you’ve come on your journey towards debt freedom.

5. Stay Consistent: Consistency is key when it comes to paying off debt. Make it a habit to update your debt payoff worksheet regularly and review your progress. Celebrate milestones along the way to stay motivated and inspired.

Download Your Free Printable Debt Payoff Worksheet

To get started on your debt payoff journey, download our free printable debt payoff worksheet. This user-friendly template will help you stay organized, track your progress, and work towards a debt-free future.

Remember, becoming debt-free takes time and dedication. By utilizing a debt payoff worksheet and staying committed to your financial goals, you can achieve financial freedom and enjoy a stress-free life.

Take control of your finances today by downloading our free printable debt payoff worksheet and start your journey towards a debt-free future.

Free Printable Galore: Grab More Today…

Copyright Notice:

We display images found on the internet, and all copyrights are held by the original owners. If you wish to remove any image due to copyright, please get in touch with us.